Frost Pllc for Beginners

Frost Pllc for Beginners

Blog Article

What Does Frost Pllc Do?

Table of ContentsSee This Report on Frost PllcIndicators on Frost Pllc You Need To KnowFrost Pllc Fundamentals ExplainedFascination About Frost PllcThe Only Guide for Frost Pllc

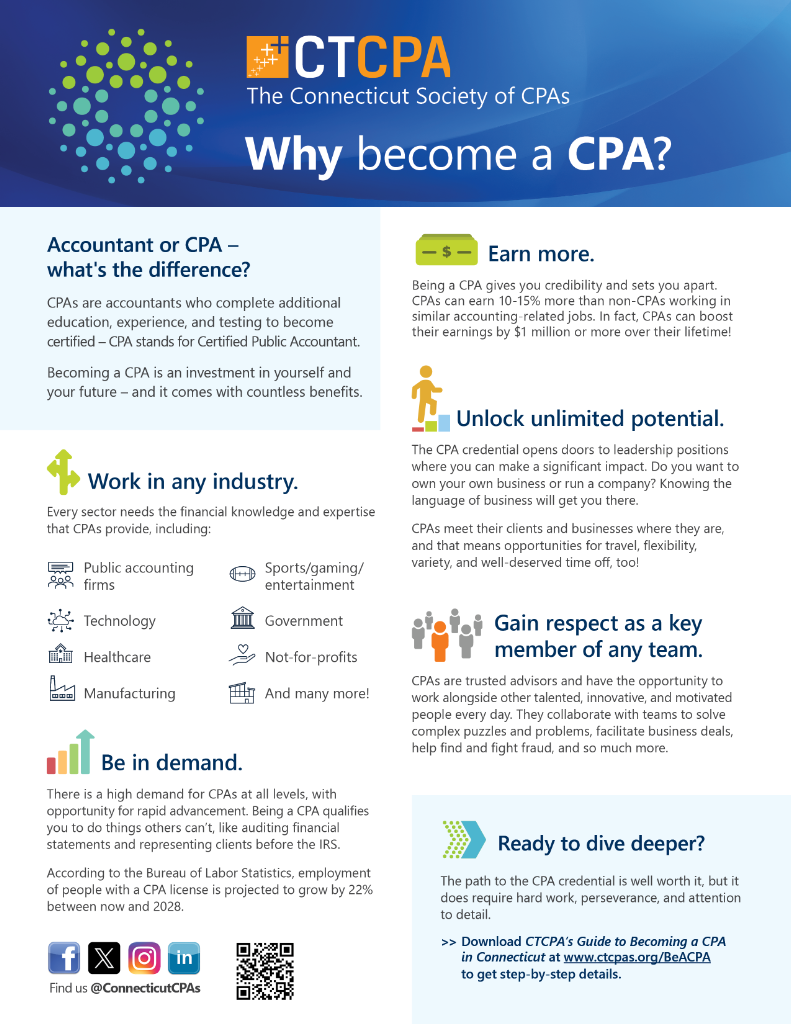

CPAs are amongst the most trusted occupations, and forever factor. Not only do CPAs bring an unparalleled level of expertise, experience and education to the procedure of tax preparation and managing your money, they are specifically trained to be independent and objective in their job. A CPA will assist you protect your interests, pay attention to and address your concerns and, similarly crucial, offer you tranquility of mind.In these defining moments, a CPA can offer even more than a basic accountant. They're your relied on consultant, guaranteeing your organization stays economically healthy and balanced and lawfully shielded. Working with a local certified public accountant company can positively influence your company's financial health and wellness and success. Below are five vital benefits. A neighborhood certified public accountant company can help in reducing your company's tax concern while guaranteeing conformity with all suitable tax obligation legislations.

This growth mirrors our devotion to making a favorable impact in the lives of our clients. When you function with CMP, you come to be part of our household.

Getting The Frost Pllc To Work

Jenifer Ogzewalla I've functioned with CMP for several years currently, and I have actually actually valued their knowledge and efficiency. When bookkeeping, they work around my routine, and do all they can to maintain connection of workers on our audit.

Below are some essential questions to direct your decision: Examine if the CPA holds an active permit. This ensures that they have passed the essential tests and satisfy high moral and professional standards, and it shows that they have the certifications to handle your economic matters properly. Validate if the certified public accountant supplies services that line up with your service needs.

Small businesses have special monetary demands, and a CPA with relevant experience can provide more tailored advice. Ask concerning their experience in your sector or with businesses of your dimension to ensure they understand your details obstacles. Understand how they charge for their solutions. Whether it's hourly, flat-rate, or project-based, understanding this upfront will certainly stay clear of surprises and validate that their solutions fit within your budget plan.

Employing a regional CPA company is more than simply contracting out financial tasksit's a smart financial investment in your organization's future. Certified public accountants are certified, accounting professionals. Certified public accountants may work for themselves or as component of a company, depending on the setup.

Excitement About Frost Pllc

Tackling this duty can be an overwhelming task, and doing glitch can cost you both economically and reputationally (Frost PLLC). Full-service CPA firms know with declaring needs to guarantee your company abide by federal and state regulations, as well as those of banks, financiers, and others. You may need to report added income, which may need you to submit an income tax return for the first time

team you can rely on. Get in touch with us for additional information regarding our solutions. Do you comprehend the accountancy cycle and the actions included in making certain proper monetary oversight of your organization's financial well-being? What is your business 's lawful framework? Sole proprietorships, C-corps, S corporations and collaborations are tired in different ways. The even more complex your earnings resources, locations(interstate or international versus local )and industry, the extra you'll require a CERTIFIED PUBLIC ACCOUNTANT. CPAs have more education and undertake an extensive accreditation procedure, so they cost greater than a tax obligation preparer or accountant. Typically, local business pay in between$1,000 and $1,500 to employ a CPA. When margins are tight, this cost might beunreachable. The months before tax obligation day, April 15, are the busiest season for Certified public accountants, followed by the months prior to completion of the year. You might have to wait to obtain your questions answered, and your tax return can take longer to complete. There is a limited variety of Certified public accountants to go around, so you may have a tough time finding one especially if you have actually waited till the last min.

Certified public accountants are the" big weapons "of the bookkeeping sector and normally do not take care of day-to-day accounting tasks. Usually, these other types of accounting professionals have specialties across locations where having a Certified public accountant license isn't required, such as administration audit, nonprofit accounting, price accounting, government audit, or audit. As an outcome, utilizing a bookkeeping solutions company is often a much much better value than employing a CPA

firm to company your sustain financial management monetaryAdministration

Brickley Wide Range Monitoring is a Registered Investment Advisor *. Advisory solutions are only supplied to customers or prospective clients where Brickley Riches Management and its reps are properly certified or excluded from licensure. The details throughout this website is exclusively for informative purposes. The web content is developed from resources thought to offer precise details, and we conduct reasonable due persistance evaluation

however, the information included throughout this internet site undergoes alter without notice and is not complimentary from error. Please consult your financial investment, tax obligation, or legal expert for aid concerning your specific circumstance. Brickley Wide Range Management does not supply legal recommendations, and absolutely nothing in this internet site shall be understood as legal guidance. To learn more on our company and our consultants, please see the most up to date Type ADV and Component 2 Sales Brochures and our Client Partnership Summary. The not-for-profit board, or board of supervisors, is the legal regulating body of a not-for-profit organization. The participants of a not-for-profit board are in charge of comprehending and enforcing the lawful requirements of a company. They additionally concentrate on the high-level technique, oversight, and accountability of the company. While there are several prospects worthwhile of joining a board, a CPA-certified accounting professional brings a special skillset with them and can act as a beneficial resource for your not-for-profit. This visit our website direct experience gives them insight into the habits and techniques of a strong managerial team that they can then show the board. Certified public accountants also have proficiency in developing and improving organizational policies and treatments and analysis of the useful needs of staffing models. This provides the distinct skillset to analyze management teams and use recommendations. Key to this is the capability to recognize and translate the nonprofits'annual financial declarations, which supply understandings into just how a company creates earnings, how much it sets you back the company to operate, and exactly how efficiently it handles its contributions. Often the financial lead or check out this site treasurer is tasked with taking care of the budgeting, forecasting, and review and oversight of the economic details and monetary systems. Among the advantages of being an accounting professional is working carefully with members of several companies, including C-suite executives and various other decision manufacturers. A well-connected CPA can take advantage of their network to help the company in different calculated and consulting functions, successfully connecting the company to the ideal prospect to satisfy their requirements. Next time you're looking to fill up a board seat, take into consideration connecting to a certified public accountant that can bring worth to your organization in all the methods noted above. Want to find out more? Send me a message. Clark Nuber PS, 2022.

Report this page